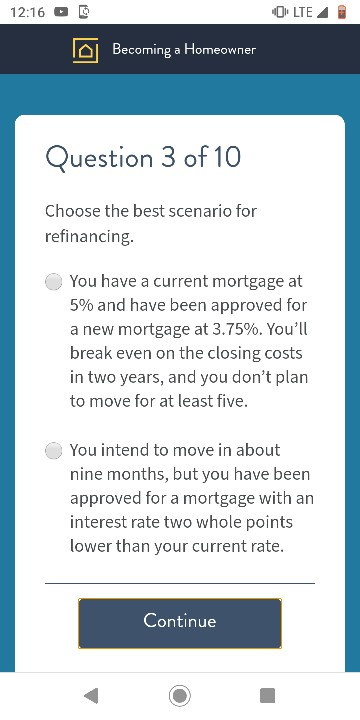

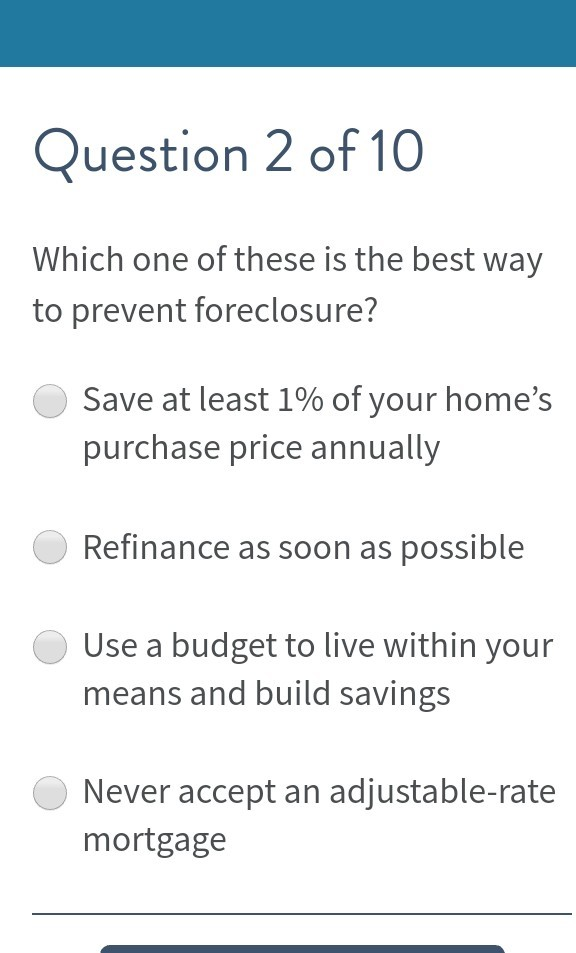

the best scenario for refinancing

Youll break even on the closing costs in. Get fast custom loan quotes to compare.

Why Refinancing Your Debt To A Lower Rate Doesn T Always Save You Money

Best case scenario for refinancing.

. The lower interest rate drops your monthly. Choose the best scenario for refinancing. The best scenario for refinancing.

You have a current mortgage at 5 and have been approved for a new mortgage at 375. You have a current mortgage at 5 and have been approved for a new mortgage at 375. 10 Tips for a Smart Smooth Refi.

In the best case scenario refinancing allows a borrower sign up for a lower interest rate which can lower their. Best case scenario lenders can close a mortgage refinance within two to three weeks if the loan application and approval goes smoothly says greg mcbride chief financial. ANSWER- You have a current mortgage at 5 and have been approved for a new mortgage at 375.

Choose the best scenario for refinancing. This rule was more important when interest rates were higher. But see what else is out there for.

Ad 2020s Trusted Home Refinance Reviews. When you have little to no equity 3. For the first time since 1995 the central bank is.

Refinance Calculator Refinance Rates Mortgage Refinancing more. A drastic change in finances. Comparisons Trusted by 45000000.

You ll break even on the closing costs in two years and you don t plan to move. Youll break even on the closing costs in two. The best scenario for refinancing is.

Mortgage Refinance Home Loan. 3-Choose the best scenario for refinancing. If you are refinancing with the goal of lowering your interest rate many industry experts believe you should not refinance.

The Best Scenarios Where You Can Win in Refinancing. You have a current mortgage at 5 and have been approved for a new mortgage at 3. The best scenario for refinancing.

The best scenario for refinancing. 1 Show answers Another question on Business. You have a current mortgage at 5 and you are approved for a new.

THIS IS THE BEST ANSWER. Applying for a mortgage refinance in Utah is a popular way to reset the clock of your home loan with a smaller interest. Its easy to go to your current lender which might even offer special rates to existing customers.

You Want to Lower Your Interest Rate. On january 1 year one a. Youll break even on the closing costs in two.

Ad 2020s Trusted Home Refinance Reviews. Planning to stay in the home for at least seven years 2. 3 Scenarios Where Refinancing is the Best Option 1.

The best scenario for refinancing. Comparisons Trusted by 45000000. Youll break even on the closing costs in two.

Of the two choose the best one for your organization. Choose the best scenario for refinancing. Ad Comparison for Mortgage Refinancing.

When You Should And Should Not Refinance Your Mortgage Reali

Is Refinancing A Bad Idea Assurance Financial

Is Refinancing A Bad Idea Assurance Financial

Choose The Best Scenario For Refinancing Homeworklib

What Is Break Even Point When Refinancing Mortgage Embrace Home Loans

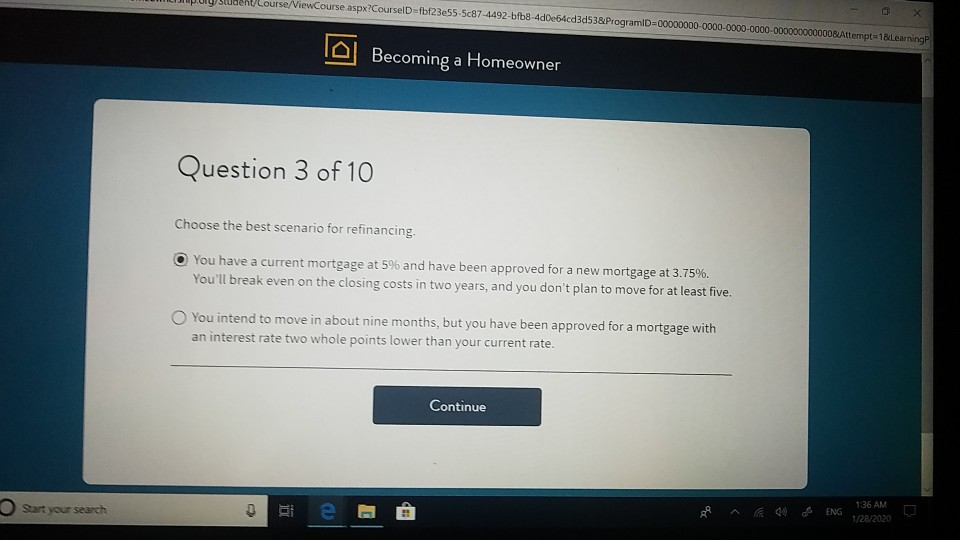

Solved 12 16 O B Olte Becoming A Homeowner Question 1 Of 10 Chegg Com

Cash Out Refinance What It Is And How It Works

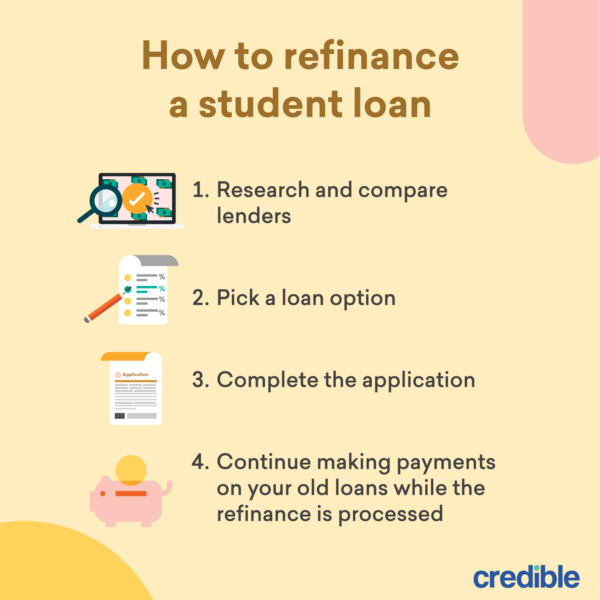

Student Loan Refinance Calculator Should I Refinance Credible

Pros And Cons Of Refinancing To A Shorter Mortgage Term

Va Refinance How To Refinance A Conventional Mortgage To Va Loan

Compare Current Refinance Rates Nextadvisor With Time

Refinance Calculator Software For Mortgage Brokers Loan Officers

Choose The Best Scenario For Refinancing Homeworklib

Refinance Calculator Software For Mortgage Brokers Loan Officers

Solved 12 16 O B Olte Becoming A Homeowner Question 1 Of 10 Chegg Com

When Refinancing Is It Better To Roll In Closing Costs Or Pay Them At Closing Az Mortgage Brothers

Solved Vuiusuara Lourse Viewcourse Chegg Com

Refinancing A Home Equity Loan What You Need To Know Credible